Recently, on-chain NFT royalties enforcement has been the center of discussion among NFT creators and artists. As a no-code NFT collection creation platform, we receive many questions about how creators can protect their royalties.

In this article we’ll break down how on-chain NFT royalties work, and how to create a smart contract that’ll allow you to enforce royalties.

What Are NFT Royalties and How Do They Work?

NFT royalties are a mechanism that allows NFT creators to receive a percentage of the resale price every time one of their NFTs are sold on a secondary market. Royalties have been a crucial part of revenue for artists and NFT creators for a long time, with many major NFT collections having made most of their revenue through royalties:

We can calculate this revenue easily (based on the current ETH price of $1,598):

Bored Ape Yacht Club

- Primary sales: 800 ETH ($1.2 million+) (0.08 ETH x 10,000 tokens)

- Secondary sale revenue: 22,254 ETH ($35 million+)

- Trading Volume: 890,187 ETH

- Royalties: 2.5%

- Secondary / Primary sale: 27x

World of Women

- Primary sales: 700 ETH ($1.1 million+) (0.07 ETH x 10,000 tokens)

- Secondary sale revenue: 3076 ETH ($4.9 million+)

- Trading Volume: 76,921 ETH

- Royalties: 4%

- Secondary / Primary sale: 4x

Goblintown

- Primary sales: 0 ETH (released as a free mint)

- Secondary sale revenue: 4,162 ETH ($6.6 million+)

- Trading Volume: 55,491 ETH

- Royalties: 7.5%

- Secondary / Primary sale: 4000x

The Downfall of NFT Royalties

After the market crash in June 2022, it became significantly more difficult for NFT creators to sell out their NFT collections. As a result, the meta of free mints became the norm, and were popularized by the success of projects like Goblintown, with creators seeking to earn royalties as their main source of revenue.

However, marketplaces such as X2Y2, Sudoswap, and LooksRare started to optimize their platform for collectors, starting a trend of eliminating creator royalties/making it optional in order to acquire more traders who wanted to maximize their profits.

But why were they able to do that to begin with?

The problem lies in how NFT standards are designed.

The NFT standards ERC-721 and ERC-1155 do not enforce royalties on the protocol level. It is just a simple piece of code that defines methods to create, transfer, or burn tokens, and doesn’t touch on royalties whatsoever.

There is a standard called EIP-2981 (Standardized API for contract-based tokens) to define royalties. However, its responsibility is just to define a standardized way for royalty information to be queried and collected by marketplaces; it cannot enforce them on marketplaces.

In other words, each marketplace currently has the ability to set their own standards for royalties, regardless of what creators would like.

Enforcing On-Chain NFT Royalties

It was OpenSea who first looked for ways to defend creator royalties.

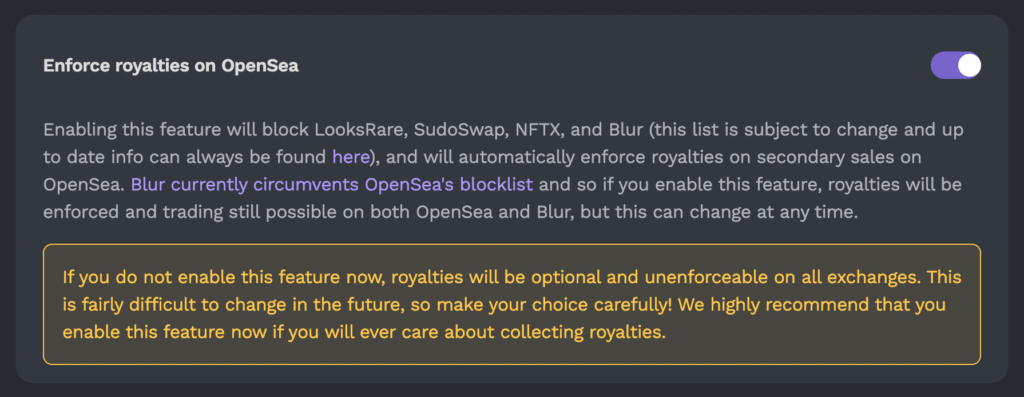

When the entire market almost gave up on continuing creator royalties, OpenSea announced a brilliant way to enforce creator royalties on-chain. This is called the Operator Filter Registry and the idea is really simple. If the smart contract of your NFT collection subscribes to the Operator Filter Registry contract that OpenSea provides, it will block all transfers for any marketplaces that do not enforce royalties. OpenSea managed the list of marketplaces, keeping an eye out for those that did not enforce royalties. If a marketplace was found to go against creator royalties, they were added to the list.

So if you are a creator who is going to make a new NFT collection (smart contract), all you need to do to protect your royalties is subscribe OpenSea’s Operator Registry smart contract. Doing so ensures that your NFTs won’t be traded on any of the marketplaces that don’t enforce royalties.

But what about existing collections?

This is where the story becomes interesting. Soon after OpenSea announced the Operator Filter Registry, Blur, a platform designed for traders, also decided to enforce royalties to new collections so that Blur could get removed from OpenSea’s blocklist. However, OpenSea didn’t remove Blur from the list because their policy required enforcing royalties for all collections, including the existing ones. Creators could technically remove Blur from the list on their own, as the Operator Filter Registry allowed them to subscribe/unsubscribe to particular marketplaces. This meant that collectors could trade on Blur with royalties enforced; however, if that happened, then OpenSea wouldn’t enforce royalties on their side.

As a result, the majority of people chose to trade on OpenSea for trades that enforced royalties.

Blur Finds a Loophole

As Blur wanted to get users back, they found a loophole to be able to bypass OpenSea’s blocklist. What happened was that Blur created a new system that used the Seaport Protocol, a decentralized web3 marketplace protocol that was invented by OpenSea for anyone to use for free, in order to build their own marketplace.

Because OpenSea itself uses the Seaport Protocol, they couldn’t block it, as it would be the same thing as blocking themselves. This new system Blur came up with automatically detects smart contracts that have OpenSea’s Operator Filter Registry. The trades for those particular smart contracts are then handled in the new system so that they cannot be blocked by OpenSea.

Therefore, OpenSea can no longer block Blur no matter what they do, even if Blur doesn’t follow OpenSea’s policy of enforcing royalties for existing collections.

As a result, OpenSea made an announcement to align with Blur’s offering – moving to optional creator earnings (with a minimum of 0.5%) for all collections without on-chain royalty enforcement. This means that all existing collections from before the on-chain royalty enforcement was put in place can no longer enforce royalties.

How HeyMint’s Launchpad Allows On-Chain Royalty Enforcement

So how can we create a smart contract that enforces on-chain royalties?

Now that we know a bit of the history and how on-chain royalty enforcement works, let’s talk about how you can create a smart contract that enforces on-chain NFT royalties.

With HeyMint’s Launchpad, a platform that can help you create smart contracts for your NFT collection without any coding knowledge, we implement OpenSea’s Operator Filter Registry by default. Because of this, the royalty rate you set will be enforced by both OpenSea and Blur.

With HeyMint’s Launchpad, you can:

- Create/manage your own smart contract that you can configure to add all of the features you need (even advanced features):

- Public sale/Presale

- Soulbound tokens

- Burn to redeem (you can configure to burn as many tokens as you want, from as many contracts as you want, and redeem them for as many tokens as you want)

- Free claim (holders of existing NFT collections can claim NFTs for free)

- Staking (the same feature Moonbirds uses)

- Loaning

- Generate art or upload art/animations you have to create NFTs

- Create a mint page that you can configure within a couple of min or create a mint button to embed to your existing website

If you want to learn more about how our platform works, check out our guides or walkthrough video to learn more. If you are new to creating an NFT project, check out our guide on How to start a NFT collection.

As a platform to empower NFT creators and artists, we are committed to support you. If you have any questions, feel free to reach out to us at [email protected].

Further Reading

Using NFT Art Generator Layer Rules to Create Your NFTs!

How to Create NFT Metadata

How to Generate an NFT

How to Create Soulbound Tokens With Launchpad

How to Start an NFT Collection