Welcome to NFTs for Dummies! This article is for absolute beginners who have little to no knowledge of digital assets on the blockchain. Don’t know what a blockchain is? That’s okay, just keep reading! This article will avoid technical talk or complex answers as much as possible. Instead, it’ll provide short, simplified responses to the most commonly asked questions from beginners about NFTs and NFT-related subjects.

So what are you waiting for? Let’s get to learning!

What Are NFTs?

NFTs (non-fungible tokens) are unique digital items which reside on a blockchain. They can be almost anything you can imagine, but most often take the form of art, music, or videos. Because they reside on the blockchain, every detail about them is visible to the public (we’ll get into that in a second). This provides creators and collectors definitive proof that they are buying and selling genuine, authentic items.

What Is the Blockchain?

We could get very technical with this answer, but instead, let’s just imagine a big notebook that everyone can read. And inside it, a log tracking every action ever made by a user. Everything from making NFTs to sending crypto, to buying or selling items is recorded in great detail. Whenever someone does something on the blockchain, that information gets added into the notebook.

In this analogy, every blockchain would be its own notebook: an Ethereum notebook, a Bitcoin notebook, etc. And each of those books has the complete information of that one particular blockchain.

What is Cryptocurrency?

Unlike the money you keep in your wallet (which is called fiat currency), cryptocurrency (or “crypto” for short) is a type of digital currency that is built upon a blockchain. There are many kinds of cryptocurrency on many different blockchains, but the two most popular are Bitcoin—which was the first cryptocurrency—and Ethereum, which is special for many reasons that we will explain later.

Which Blockchain Are Most NFTs On?

Ethereum is by far the most popular blockchain for NFTs.

You may be wondering why Bitcoin, the first blockchain, isn’t the leader. The simple answer is that Bitcoin was not developed with NFTs in mind. Rather, it was made as a decentralized method of making and receiving transactions. By decentralized, we mean that the currency would not be under the control of any single authority, such as a bank, government, or country.

Ethereum was released six years after Bitcoin went public. It quickly gained attention for popularizing something called “smart contracts”. Smart contracts are programs stored on a blockchain that run when certain conditions are met. It is these smart contracts which allow NFTs to function as they do today.

While Ethereum was the first smart contract platform for NFTs, there are now many blockchains which support them, including: Solana, Tezos, Flow, and more.

Are “Digital Collectibles” NFTs?

Yes. “Digital collectibles” is just another name for NFTs; a name that has been growing in popularity recently. It is arguably the result of companies trying to find a better name that the public can relate to and understand. A “digital collectible” has the added benefit of distancing itself from the term “NFT”, which many people have a negative perception of. This may be in part because of years of misconceptions and misunderstandings about NFTs.

If you’d like to explore this subject in greater detail after finishing this article, feel free to check out The Ultimate Guide to Digital Collectibles.

What Are Wallets?

Pretty much exactly what it sounds like—wallets are a place to put your money. When we’re talking about NFTs and crypto, however, a wallet is digital place to store your crypto and other assets.

For Ethereum, the most popular wallet is MetaMask, which is easy to install and get started with, as the video below demonstrates.

What Is a Seed Phrase?

All wallets are secured with something called a seed phrase.

A seed phrase (also called a recovery phrase) is a 12-24 word master password, made up of a series of randomly assigned words. Your seed phrase is provided to you when you set up your wallet for the first time. Beyond that, it is only necessary to enter your seed phrase if you need to recover your wallet (like in the event of a lost or damaged device), or, when you’re setting up your already established wallet on a new device.

Your seed phrase is the single most important thing in this space. You must keep safe. Failure to do so can have disastrous consequences, like you permanently losing access to all of your funds.

Can I Access My Crypto If I Forget My Seed Phrase?

No. Unlike nearly every password you’ve ever encountered in your life, there is no way to recover your seed phrase if you forget it or lose it. This is referred to as having “self-custody”, meaning you are the only one in control of your money. While there are numerous advantages to self-custody, it carries with it a ton of personality responsibility.

It is highly advised that you store your seed phrase in an extremely secure location that is not connected to the internet in any way. Some people go to additional methods to protect themselves. This can include things like embedding your seed phrase on fire/water/acid resistant metal, and/or splitting your seed phrase into multiple parts which are then hidden at different locations in order to reduce the chances of it being stolen.

What Is a Wallet Address?

A wallet address is a string of characters generated randomly when you first make your wallet. It serves as your ID on the blockchain. Your wallet address is the destination where people can send crypto, NFTs, or other assets to you.

How a wallet address looks will vary wildly depending on the blockchain it is on. For example, Ethereum addresses are 42 characters long, and all of them begin with 0x.

0x561B6d823B7e2c2e68232fA2F3AF2FbabE4E6125 is an example of what a wallet on Ethereum will look like.

Please note that each blockchain has its own system of wallet addresses and they are not the same. Because of this, you should never send money from a wallet on Ethereum to a wallet on Bitcoin. Likewise, you’d never send crypto from a wallet on Bitcoin to a wallet on Solana. If you do so, the money will be lost forever, and there is no way to recover it.

What Are Hot Wallets?

Think of a hot wallet as an internet connected piece of software on your computer. They are free, and allow you to store your crypto and/or access your NFTs. Hot wallets are generally used quite often.

As we already established, the most popular hot wallet on Ethereum is called MetaMask.

If you only use hot wallets, you should be extra vigilant to remain safe. Always read transactions before you sign them, and don’t sign them if you have any literally any doubts or concerns. Be careful of what you choose to mint, and avoid clicking on links unless you are certain that they are safe.

What Are Cold Wallets?

A cold wallet is a physical device, not connected to the internet, meant to secure your crypto and other assets. Part of the way they do this is by forcing you to make a manual button press on the device in order to approve any transaction.

Used effectively, this makes it significantly more difficult for someone to steal your assets, as it would require access not only to your wallet, but to your physical device as well. As the cherry on top, cold wallets are locked by their own password, before the device will even operate.

Because they aren’t free and are a bit more cumbersome, cold wallets are typically used for storing assets of higher value and/or more significant sums of crypto. They are generally used more conservatively and infrequently than hot wallets.

That being said, all wallets have a seed phrase. Hot or cold, if someone has your seed phrase, they will be able to bypass your security, access your wallet, and transfer all of your assets and crypto. We must reiterate, always keep your seed phrase safe and secure, and be sure that it is only stored offline.

If you’d like to buy a cold wallet, we’d be thankful if you used one of our affiliate links below. By purchasing, not only will you help protect your assets; you’ll also be supporting our platform and funding additional helpful resources such as this.

Ledger and Trezor are the two most popular cold wallet manufacturers at the moment, although Keystone has also been growing in popularity.

Ledger: (Main Shop Page / Ledger Nano S Plus / Ledger Nano X / Ledger Stax)

Trezor: (Main Shop Page / Model T / Model One)

Keystone: (Main Shop Page)

How Do I Put Money in My Wallet?

Although NFT marketplaces are increasingly allowing people to make purchases with fiat currency (like credit cards), the vast majority of purchases that people make require the native currency of the blockchain. For example, most NFTs are on the Ethereum blockchain, and the currency of Ethereum is called Ether.

To buy that initial Ether for your wallet, most people use what is called a Centralized Exchange (CEX). Coinbase and Binance are two of the most popular. You may connect your bank account and purchase crypto on an exchange. You do this by paying an equivalent amount of fiat currency (like USD) for your crypto of choice, plus a small service fee. Once you’ve done that, you can withdraw your new crypto funds to the wallet address of your choice.

Make sure you copy and paste the address directly from your wallet to avoid making any mistakes. Remember: if you send the funds to the wrong address, it is the same as burning your money. Transactions are irreversible.

What Is Minting?

Minting an NFT is the process of interacting with the smart contract in order to generate an NFT for the first time. This is also known as “the primary market”, as you are the first individual to own that particular NFT.

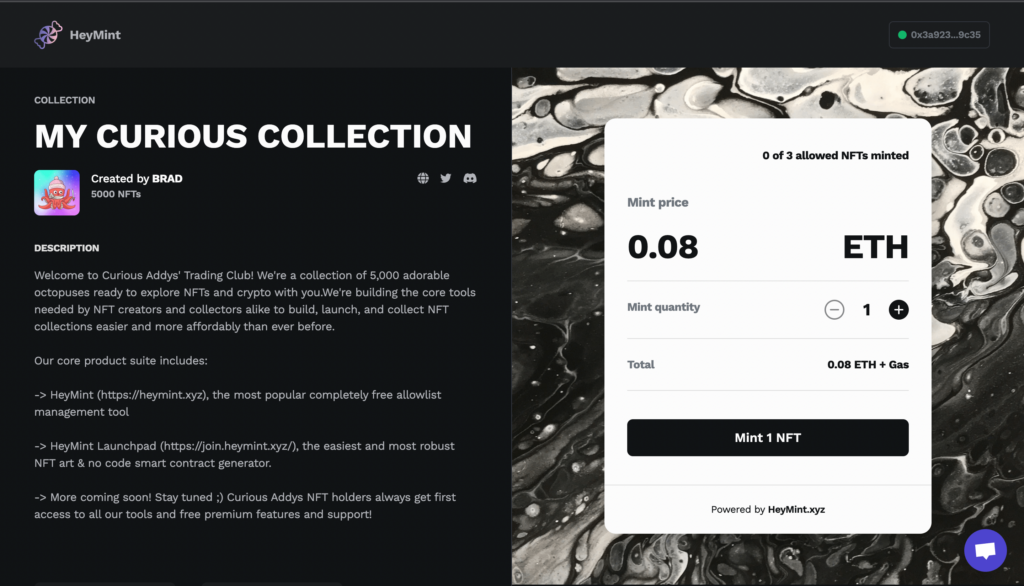

Minting is typically done on a website or “mint page”, and involves connecting your wallet to the site and making a transaction. The cost of the transaction varies due to a number of factors, but will always come down to whatever mint price the creator has set + a gas charge.

What Is a “Gas Charge” on Ethereum?

A gas charge is a small transaction fee which is paid to the network validators on the blockchain. I know that sounds like gibberish, so to put it another way, it’s a tiny charge given to those who help keep the network safe and secure. Without gas charges, few people would volunteer to stabilize the network, and as a result the blockchain would be at risk.

This mutual arrangement works to everyone’s benefit.

PS: Gas charges exist on other blockchains as well. The recipient of those fees may differ depending on the blockchain, but we don’t need to get into that as of yet.

Where Can I Buy & Sell NFTs?

There are two distinct methods: either directly through a minting website (called a “primary market” as mentioned earlier), or through an NFT marketplace (called a “secondary market”), which largely deals with the reselling of previously minted work.

Most people’s first experience with NFTs is through a secondary market.

Of the secondary markets, the biggest NFT marketplace is called OpenSea. But there are many others including LooksRare, Rarible, Coinbase NFT, Blur, and X2Y2. While some of these marketplaces deal with multiple blockchains, their main focus is on Ethereum.

Other blockchains also have their own NFT marketplaces, such as Magic Eden on Solana or Objkt on Tezos.

When buying on a secondary market such as OpenSea, your main options for purchasing NFTs is either to “buy it now” at the owner’s listed price, or make your own offer with WETH. If you are selling, it works the same way but in reverse: you can list the “buy it now” price which people can pay to immediately buy your NFT, or you can accept a WETH offer than someone sends you.

What is Wrapped Ether (WETH)?

Avoiding the technical talk, just know that WETH stands for wrapped Ether and you will most likely first encounter it on OpenSea. On OpenSea, WETH is used to make an offer to buy an NFT, or to bid on an NFT that is already up for auction.

WETH allows the user to pre-authorize their bids ahead of time. Should your bid be accepted by the seller, the transfer will automatically happen without any further action required on your behalf.

If this is something you’re interested in, OpenSea has a step-by-step guide on how to get WETH, convert ETH to WETH (called “wrapping”), or WETH back to ETH (called “unwrapping”).

What Are Royalties?

Royalties are payments made to the original creator of an NFT for every secondary sale it sees.

For example:

– Armond makes an NFT, sets the price as 0.08 ETH, and sets the royalty rate to 5%.

– Armond’s NFT is now purchased by Tanya for 0.08 ETH.

– Tanya sells the same NFT for 0.25 ETH to Kai. Armond receives 5% of 0.25 ETH (0.0125 ETH).

– Kai then sells the NFT for 1 ETH to Belinda. Armond once again receives 5% of 1 ETH (0.05 ETH).

So in this example, Armond made 0.08 ETH from his initial sale, plus 0.0625 ETH from the royalty fees he earned just by Tanya and Kai reselling the piece he made. This process can go on indefinitely.

Royalties are one of the most fascinating aspects of NFTs, particularly when it comes to artists, as secondary sales can continue to provide a source of revenue even after their artwork has left their hands.

Keep in mind, however, that not every marketplace has been consistent in honoring creator royalties, and some have flipped their stance back and forth. X2Y2, LooksRare, and Blur are three marketplaces which have eschewed royalties in one form or another, but all three have gradually come around to public pressure and enabled them over time (albeit with some tweaks).

OpenSea, the most well known and largest NFT marketplace, continues to honor creator royalties. On the other hand, SudoSwap is one of the only marketplaces that is unwavering in not honoring royalties.

All this is to say that you should double check an NFT market’s stance on royalties before listing your piece there, if creator royalties are important to you.

What Do I Need to Make an NFT or NFT Collection?

If you’re just making a few simple NFTs or are experimenting with the process of selling, you can do what is called “lazy minting” through a platform like OpenSea, which simplifies the process at the expense of a few caveats (for more on that, you can read OpenSea’s minting guide).

But that may not be an ideal scenario for a lot of people. For example, if you plan on launching a larger collection, and if you want the ability to sell your work on multiple marketplaces, then lazy minting can be rather restrictive and cumbersome. Similarly, if owning your own smart contract and retaining complete control of your project is important to you, you may want to look elsewhere.

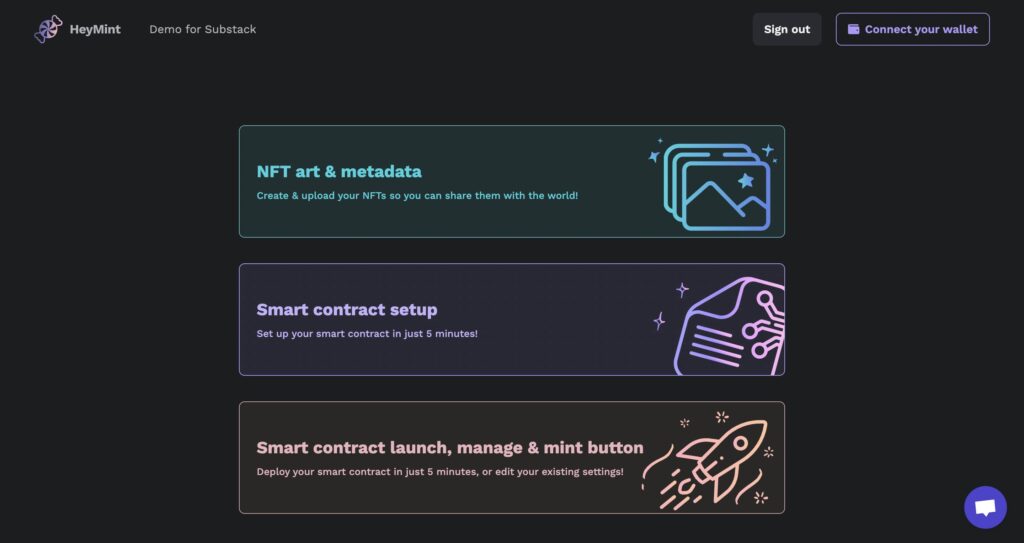

Luckily, there’s Launchpad, a no-code NFT creator toolkit we built to help you do everything that goes into making a NFT collection. From art generation to setting up your mint page, running allowlists for people interested in minting your work, to managing your collection pre and post mint, Launchpad helps creators realize their vision.

Are All NFTs a Scam or Ponzi Scheme?

No. Blockchain technology and NFTs are very real, and everyone from Meta (Facebook), Starbucks, Reddit, and dozens of the biggest brands in the world have already invested billions into establishing a foothold in it.

However, there are a lot of scammers online, just as there are anywhere on the internet, so it’s important to remain safe. This is especially true right now, as the technology is still new, people don’t understand it, and a lot of the laws and protections concerning cryptocurrency have yet to be firmly established.

Likewise, there are many creators who make a project that effectively runs like a Ponzi scheme. That is why it’s important to do your research beforehand, not rush into things, and learn to recognize the warning signs. As a general rule, you should remain vigilant in the space and assume that people are out for your money.

The good news is that all of this is becoming less prevalent with time, as people slowly become more educated, and the tools to protect people are becoming more robust and intuitive.

How Can I Stay Safe?

This is a complicated question with a lot of potential answers, but as a golden rule: if something sounds too good to be true, it is.

Here are some suggestions for what you can do to remain safe online:

- Buy and use a cold wallet as soon as possible.

- Don’t make purchases on short notice, without doing your research, or when you feel pressured by time.

- Likewise—and it should go without saying, but— avoid making financial decisions while tired, or under the influence.

- Don’t click on any suspicious links. And if you don’t know someone, don’t click on ANY of their links.

- If you use Discord, make sure to disable your DMs on any server you join. Direct messages are one of the main attack vectors that scammers will try to use to get to you.

- Stick to well established NFT marketplaces that everyone uses, rather than new or obscure places you haven’t heard of.

- Never share your screen or install software that allows remote access to your computer.

- Do not store your seed phrase anywhere online: not in your email, not in a notepad file, not as a screenshot backed up to the cloud. NOWHERE ONLINE.

What Are Even More Ways I Can Stay Safe?

- Avoid trades whenever possible, at least early on before you know the risks.

- When signing transactions, make sure to confirm that what you’re interacting with is what you are trying to do. If you have literally any doubt as to whether the transaction appears safe, do not sign it, just abort.

- Use a browser extension like Pocket Universe to give you clear descriptions of what you’re signing and help protect you from phishing scams and wallet drainers.

- For good wallet maintenance, or if you think your wallet has been compromised, you can use Revoke Cash to see what sites you’ve given permission to, and revoke anything that looks suspicious.

- Be comfortable with missing out. No matter what you do, you will miss out on most of the cool stuff that happens in this space, and that’s okay. The amount of amazing projects and opportunities is not finite. If you let FOMO (fear of missing out) guide your decisions then you will make a lot of painful mistakes.

For more security advice, read NFT Scams: 10 Types You Need to Know.

What Does This Word Mean?

Sooner or later you will come across words or acronyms that you don’t understand. The NFT world and the technology surrounding it is full of new terminology to learn. Don’t be overwhelmed: you will pick them up with time.

Want to look up a specific word you’ve come across? Check out our article, NFT Terminology: Your Destination for Confusing Crypto Language for clear definitions.

Where Do I Go Now?

So after finishing NFTs for Dummies, you’re eager to join in. Great! Here are some suggestions of where you can find NFT communities, and learn more about them.

Discord: a communications app with text, voice, and video. Discord is where most NFT communities engage with their users. Although it can be chaotic at times, it is currently your best bet. This is especially true if you’re looking for info about a specific project or community.

Twitter: nearly as important as Discord, Twitter is also essential. Of special note are Twitter Spaces, which are live audio discussions. Spaces are an excellent way to learn from others and establish yourself online. Be sure to expand your circle broadly so that you don’t live in a bubble. The more diverse and informed people you follow and interact with, the more useful Twitter will be. Many users also find it helpful to make lists in order to organize and follow specific groups of people.

Substack: a newsletter service, Substack has become popular with the crypto and NFT communities. Substack is useful for finding people who recap all of the major news in the space. It’s also good for following thought leaders who go more in depth with long-form content. Once subscribed to a Substack, new issues can be delivered straight to your email. We must recommend our Curious Addys Substack for thoughtful web3 analyses, of course. Some other excellent choices include Zeneca 33, and Overpriced JPEGs. On the business and marketing end, few do it better than Lenny’s Newsletter.

And of course, you should subscribe to HeyMint Blog for more useful articles such as this.

And that’s NFTs for Dummies! Thanks for reading, and good luck on your NFT journey!

Further Reading

NFT Terminology: Your Destination for Confusing Crypto Language!

9 Things That Prevent You From Getting “Sad” as a Web3 Founder in a Bear Market

How to Create NFT Metadata

An NFT Marketing Plan: Grow Your Twitter from 0-20k Followers

How to Grow Your Discord Server: for Web3 & NFT Projects